2025 Wide Format Graphics Inkjet Forecast

It was a challenging year for wide format graphics printer hardware in 2024. Hardware unit shipments dropped about 15% from 2023 to 2024. Most of the decline occurred in sales of aqueous wide format printers, but eco-solvent/latex and UV-curable unit sales also declined.

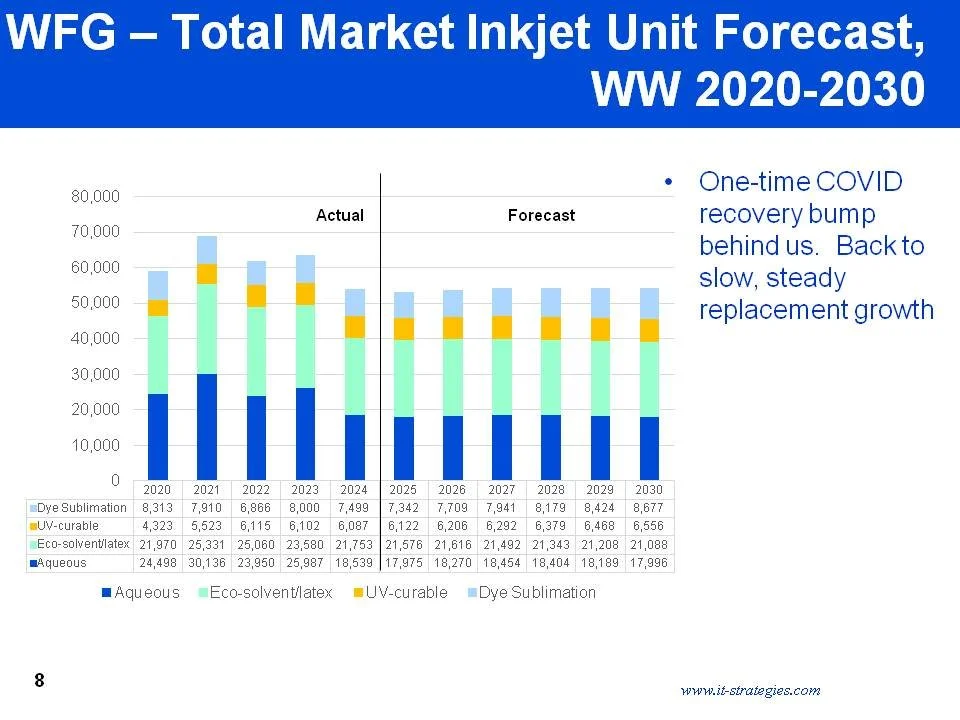

Figure 1 Total Wide Format Graphics Market Inkjet Unit Forecast, WW 2020-2030

IT Strategies believes the decline in sales is not due to a single but rather a wide range of factors. The simple explanation is that the market is going through a re-adjustment after having seen strong recovery coming out of COVID from 2021-2023. Print shops and in-house users are absorbing the capacity they purchased in the previous three years, with COVID having essentially disrupted the regular replacement cycles we saw before COVID.

The more worrisome hypothesis is that shifting trends in marketing preferences, plus rising costs for wide format graphics output, is starting to take a toll on new hardware sales. Brands are shifting more of their communication budgets to electronic communication, moving investments into mobile marketing to have more direct and instant contact with their customers and prospects. They still need wide format print, but they may be less budget available for that communication channel. If this is correct, it is likely to be a long-term shift in demand that will negatively affect future wide format graphics output volume in the years to come.

Another factor in the decline in new hardware sales is likely to be the economy. As the 30+ year-old wide format graphics inkjet market has long been a replacement market, softening demand for output appears to have had a strong effect on demand for new hardware replacements in 2024. Printshops are holding onto their wide format graphics printers longer, and simultaneously large well-resourced print providers, often using e-commerce platforms, are starting to consolidate output by shifting production onto high-productivity, lower-cost output devices. These shifting trends have hit the lower (sub- $30,000) wide format graphic printer sales hard in 2024, lowering unit sales volumes significantly.

A fourth factor that could be looming is devaluation in pricing power as Chinese manufacturers increase exports of UV-curable printers. While quality, service, and marketing reach are not on par with Western wide format printer manufacturers, the wide spread use of Epson PrecisionCore printhead with Chinese UV-curable printers is providing Chinese equipment manufacturers with credibility that didn’t come as easily before. Chinese wide format equipment manufacturers have made progress in improving machine and output quality, at equipment and ink prices that are lower than Western manufacturers. Chinese manufacturers have made in-roads in to selective regions in the UK, Spain, Italy, and Easter European markets. They don’t have the capital resources to establish a European-wide presence, and rely mainly upon dealers (hence their selective regional presence), but the net effect is their presence could start to put pressure on Western wide format graphics hardware and ink pricing. Note that at FESPA 2025 in Berlin over 40% of the exhibitors were Chinese manufacturers, often using Western sounding names. There has been very limited presence of Chinese manufacturers in the US so far, as nationwide dealers are unlikely to risk their long-standing relationships with Western manufacturers. The 2025 US tariffs on Chinese products are also likely to cause a barrier on increasing the presence of Chinese wide format graphics printers in the US market, but may cause the Chinese manufacturers to pursue sales into the European markets more aggressively. The impact of Chinese wide format graphics printer manufacturers in Europe and the US is not a big factor today, but it is a concern.

With all these concerns, IT Strategies does not foresee renewed growth in 2025 for hardware unit sales given the geo-political instability around the world. This is particularly a problem in the US market which accounts for about 1/3 of wide format printer sales, where the lack of tariff predictability is making planning very difficult.

There is a silver-ling perhaps, and that is the fact that about 60% of revenues for manufacturers of wide format printing comes from ink and service. The instability for the general US economy is leading to higher prices, possibly re-igniting inflation, which in a turn could help top line revenues remain stable even as hardware sales are likely to remain challenged in 2025. IT Strategies expects total wide format printer manufacturer revenues to remain stable in 2025, and growth through 2030 at 4% annually, a projection that includes inflation.