The Continuous Feed Ink Jet Production Market – 2025

The results for 2025 continuous inkjet production printer sales are expected to remain sluggish as they were in 2024. In 2024, overall engine unit sales were up slightly, but retirements resulted in a flat installed base, with little page volume growth.

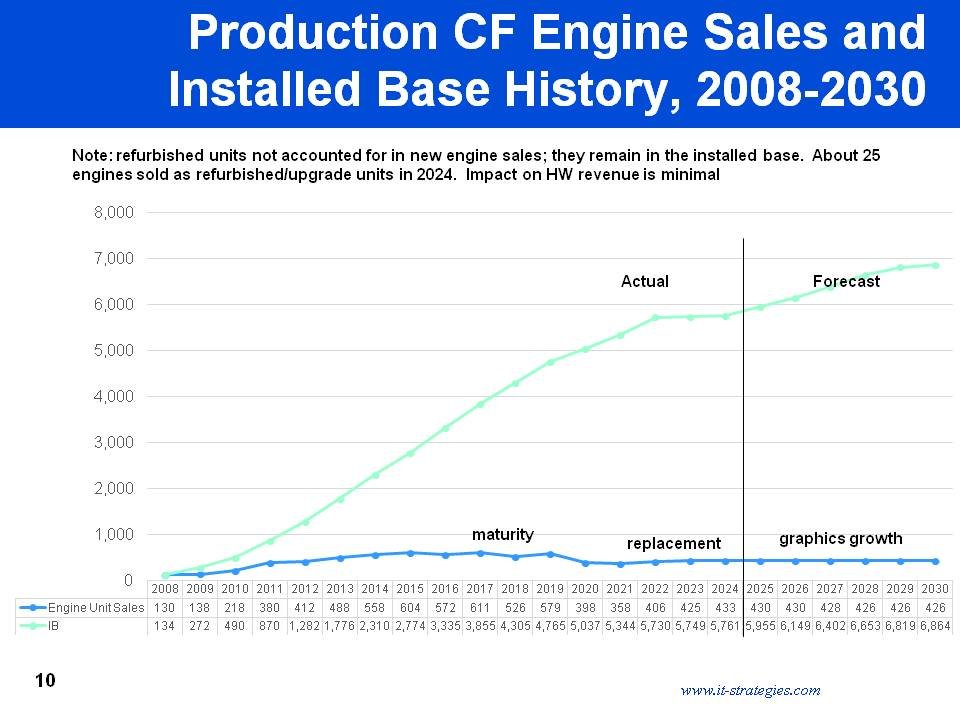

Figure 2 Continuous feed inkjet engine sales and installed base, WW 2008-2030

Source: IT Strategies, Inc.

The good news is that rising ink prices and increasing page coverage in some applications helped to modestly drive-up ink revenues, resulting in a slight total revenue increase from 2023/2024. Due to the size of the installed base, the impact of new high-ink coverage graphics arts continuous feed printers remains minimal, but the stage is set for renewed growth in the coming five years, with the installed base, pages, and vendor revenues projected to grow at 3%, 7%, and 7% CAGR respectively from 2025 to 2030.

Despite the system market maturity, the page volumes printed in the continuous feed market will continue to far outpace the cut-sheet inkjet and toner markets. We are at a stage where the productivity of these continuous feed presses is able to start to replace offset pages, as ever shorter-runs and high offset set-up time/cost makes offset less economical than before.

IT Strategies is projecting continuous feed inkjet manufacturer revenues for hardware, ink, and service will reach over $2.4B by 2030, making it one of the top three non-consumer/non-office printer markets in the world. The high-volume economies of scale from continuous feed inkjet will also pay dividends in printhead and ink manufacturing for the core printer manufacturers in this segment.