Inkjet Integrators 2025

There are hundreds of inkjet integrators around the world, fueled by readily available inkjet printheads that have become simpler to integrate into printing systems, as well as growing ink fluid options enable the ability to address a broader range of print applications. Interestingly, despite the ready availability of lower-cost printheads, the number of integrators tracked by IT Strategies is declining (except for China).

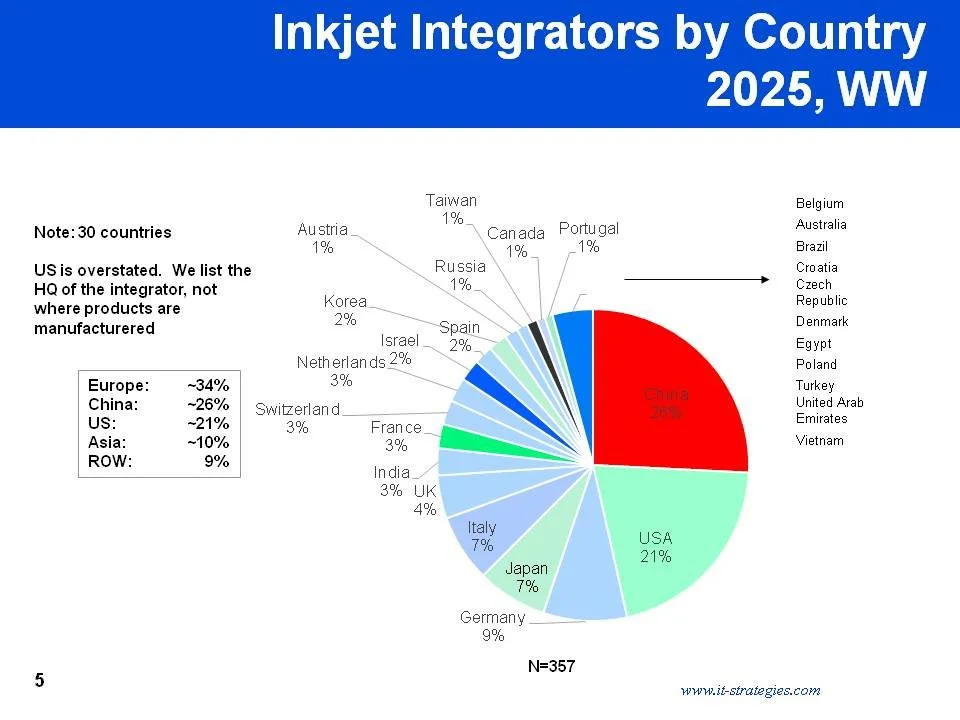

Figure 1 Number of Inkjet Integrators by Country of Origin, 2025 WW

About 90% of integrators on our list have revenues of under $20M annually. Many of the smaller ones have found themselves in cashflow challenges coming out of COVID, challenges which amplified during the geo-political/economic challenges in 2025. A key part of the challenge for many is that while there are low-barriers to entry to develop a product with OEM printheads, there are high-barriers to substrate/performance testing and funding sales/marketing/service (e.g., Velox Digital). And with contract integration projects down in 2025, even some of the $20M ones can’t scale down fast enough.

Conversely, the number of Chinese integrators keeps on growing. IT Strategies integrator list now tracks 92 Chinese integrators, and undoubtably there are many, many more running under the radar. As some of the larger ones become more skilled (e.g., Flora, Hanglory), Western inkjet brands are increasingly becoming more interested in using Chinese inkjet integrators as contract manufacturers as they offer significantly lower integration cost than in the Western world.

The question no doubt on everyone’s mind is what is the next growth area? Two years ago, it appeared that many of the printhead manufacturers were aiming move up the value chain expanding into inkjet integrators. Providing print engines (including the electronics, fluid supply systems, maintenance systems, etc.) printhead providers making it easier for brands to deploy inkjet technology into their operations. What seems to have happened however is that while the inkjet engines can be “standardized”, there is much custom integration required due to application and customer specific requirements that vary from brand to brand. This made it less profitable than expected, and integration contracts did not necessarily repeat, unlike printhead sales.

In 2025, the big buzz seems to be around coatings for EV automotive batteries, coatings for perovskite solar cells, 3D printing, and moving up the value chain to provide branded inkjet products. There is much potential in these areas, but also lots of technical and cost/performance challenges and success is not assured. Meanwhile for the last three decades it has been and remains wide format graphics printing that tops the list of the largest number of integrators. Coding has grown to be the second largest segment of inkjet integrators, which IT Strategies expects will continue to grow as new 2D barcode marking and coding requirements take off. The good news is there seems to be enough business for everyone, provided they are able to run a business as a professional rather than technology driven business. Cashflow is king for all of the smaller integrators, even among the rapid growing number of Chinese integrators.