How many print service providers are there?

Sizing the number of estimated sites per sector is an art, not a science. No one is exactly sure how many sites there are, but one can triangulate a data point through the use of US public government data, trade associations, and IT Strategies forecasts on number of digital production printers sold. IT Strategies has strong confidence in the US site data, but there are too few public data sources outside of the US to derive credible site estimates. IT Strategies used GDP ratios to model the other regions, and however imperfect, it provides some sense of scale and upper limit on the eligible market for digital printers.

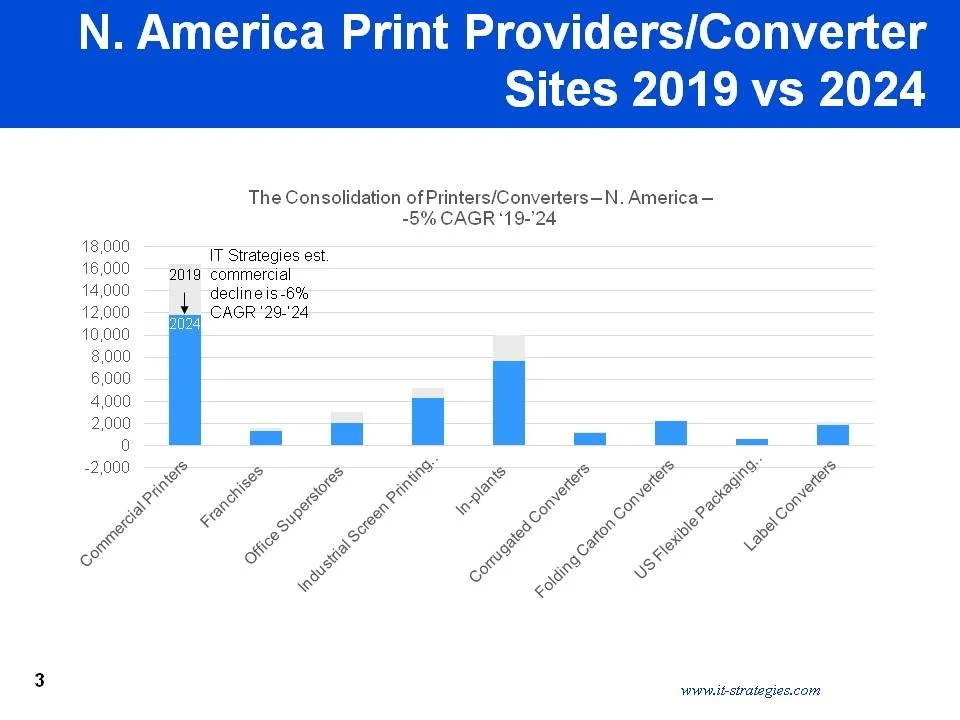

Figure 1 N. America Print Providers/Converter Sites 2019 vs 2024

Source: IT Strategies, Inc.

Based upon merger and acquisitions, bankruptcies, and general closures, we know that the number of print service providers (commercial printers, screen printers, label and packaging converters, etc.) has been shrinking since about 2012, and is continuing to shrink. The Covid pandemic forced many of the financially weaker print providers and converters to disappear (with delayed effect in the US and EU due to government support/subsidies) between 2019 and 2024. This year, 2025, could be a pivotal year for many of them, as instability caused by global trade tariffs, changes in immigration policy, inflation, and general conservatism among people who buy print are causing some of the smaller operations to become insolvent.

One of the reasons to track the number of sites is to be able to gauge the potential market opportunity (or the ceiling limit) of the number of a digital production printing devices could be sold into a given market. In this reports IT Strategies is focused on sites that are able to buy $1M+ digital production printers.