Digital Label Printing Forecast 2025

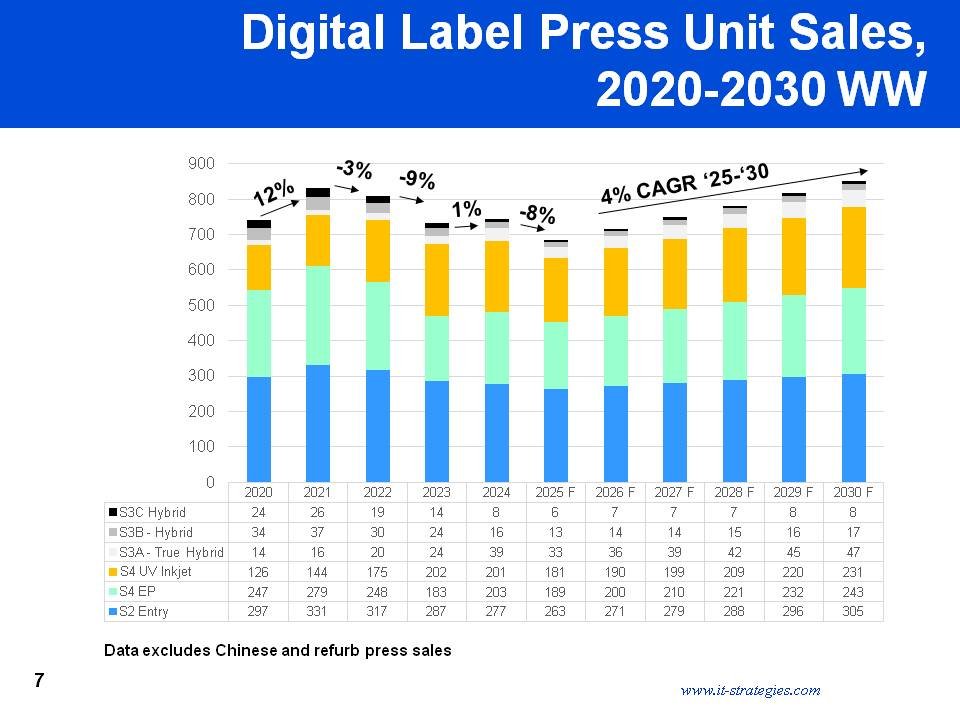

The 2024 total unit shipment numbers hide the underlying relatively weak 2024 market, as the totals include strong replacement sales in S4 EP segment after poor 2023 sales. Most digital label press manufacturers saw flat/slightly declining unit shipments in 2024. The growth in S3A hybrid units stemmed from a relatively new digital inkjet vendor who managed to place units in large EU accounts, some for folding carton applications.

Figure 1 Digital Label Press Unit Sales, 2020-2030 WW

Source: IT Strategies, Inc.

Looking back, 2024 units sales totals remain at about 2020 levels. One key reason is that converter consolidation and investment in software has extended the life of flexo presses, even as it becomes more challenging to find flexo press operators.

Looking forward to 2025, all the trends aforementioned are causing conservatism in capital investment in 2025. The projected 2025-unit sales decline resets the growth in years going forward. IT Strategies is projecting an average decline of -8% in unit sales in 2025. The big wild card is trade tariffs. It is impossible to predict what the impact of specific tariffs will be on manufacturers who produce products outside of the US, as the rate of tariffs are constantly being re-negotiated.

Digital label printing will continue to help label converters balance their workloads between long and short-runs, between quick and longer turnaround, and versioning and variable data. IT Strategies projects market revenue growth around 7% from 2025 to 2030.